here are list of frequently asked questions, please add a comment if you have any additinal questions

How prediction markets are different than sportsbooks / bookies?

How is Polymarket different from other prediction market platforms?

In a contested market, how can I make an argument for what I think is the correct outcome?

How can I recover my funds if sent out the wrong cryptocurrency on Ethereum or Polygon?

What is Polymarket?

Polymarket is the world's largest prediction market. It covers the widest range of events and has the largest liquidity pool. It is also backed by reputable US investors such as Vitalik Buterin, the co-founder of Ethereum, and Founders Fund, a venture capital firm founded by Peter Thiel

What are prediction markets?

In a prediction market, you can buy and sell contracts on the outcome of events. Contract prices reflect the traders' views on the likelihood of the event happening. Each contract is worth $1 if you're right.

Like stock markets, prediction markets deal in markets, but with a key difference: what’s being traded. In a traditional stock exchange, you buy and sell shares of ownership in companies. In prediction markets, on the other hand, you trade contracts based on whether specific events will happen, like 'Will Donald Trump win the 2024 presidential election?'

Think of it as predicting the future, with the price of the contracts reflecting the collective prediction of the market participants

How prediction markets are different than sportsbooks / bookies?

Prediction markets like Polymarket and traditional sportsbooks/bookies both allow people to place bets on the outcomes of various events, but they operate under different models and have distinct characteristics.

Market Structure

Prediction Markets:

Operate as decentralized, peer-to-peer platforms where users trade shares representing the outcome of an event.

Do not take a position on the bets, meaning the result of the event is indifferent to the platform.

Prices are determined by supply and demand, reflecting the collective wisdom of market participants.

Users can both buy and sell shares, often allowing them to exit positions before the event's conclusion if they choose.

Sportsbooks/Bookies:

Operate as centralized entities that set the odds for various outcomes.

Users place bets against the bookmaker, who effectively takes the opposite side of the bet.

Odds are set by the bookmaker and might be adjusted based on betting volume or other factors, but they are not directly determined by a peer-to-peer market.

Pricing Mechanism

Prediction Markets:

Prices fluctuate continuously based on real-time trading activity.

The current price of a share generally reflects the probability that the market believes an event will occur. For example, a share priced at $0.70 suggests a 70% probability of that outcome happening.

Sportsbooks/Bookies:

Odds are set by the bookmaker and usually do not fluctuate as dynamically as prices in a prediction market.

Odds reflect the bookmaker’s assessment of the probability, often incorporating a margin (vig) to ensure profitability.

Payout Structure

Prediction Markets:

Payouts are determined by the final share prices at the event's conclusion. A correct prediction will pay out $1 per share, minus the purchase price, while an incorrect one pays nothing.

Users can also sell their shares before the event concludes, locking in profits or limiting losses.

Sportsbooks/Bookies:

Payouts are based on the odds at the time the bet was placed. If you win, you receive your stake back plus winnings based on the odds.

There is typically no option to exit a bet early (with some exceptions like cash-out options).

Liquidity and Market Efficiency

Prediction Markets:

Rely on user participation for liquidity. High participation can lead to more accurate and efficient markets, but low participation can lead to volatility and less accurate prices.

Sportsbooks/Bookies:

The bookmaker provides liquidity, ensuring that you can always place a bet, but this comes with the bookmaker’s margin, which can reduce the value to the bettor.

How is Polymarket different from other prediction market platforms?

By far, Polymarket has the largest liquidity of any prediction market platform. Compared to Kalshi, another prediction platform, Polymarket covers political events and a wider range of events, from sports to geopolitics, while Kalshi is more focused on economic events. Additionally, Polymarket does not have fees at the moment.

Compared to PredictIT, a leading prediction platform focused on politics, Polymarket does not have any fees or maximum betting limits

Are there any fees on Polymarket?

No, as of today (August 26, 2024), Polymarket does not charge any fees, either to place an order, deposit, or withdraw money. The only fees you would need to pay are the gas fees on the Polygon network to transfer money from your wallet to your Polymarket wallet.

How does Polymarket make money?

At the moment, Polymarket operates at a loss and is funded by venture capital money. They recently raised over $70 million from reputable U.S. venture capital firms to continue growing the platform.

Who does create markets?

The Polymarket team decides which events are traded on the platform and the resolution rules. However, they are very receptive to suggestions from users

Can I propose a market?

Yes, the Polymarket team accepts suggestions from users and is usually very receptive to requests. You can make a suggestion or submit a market proposal in the Polymarket Discord, specifically in the market submission and market suggestion threads.

What happens when a market is created?

When a market is created, the starting prices for YES and NO shares are defined algorithmically by Polymarket and automatically adjusted as user orders come in. Liquidity in the market is ensured by an Automated Market Maker (AMM), which is a decentralized asset trading pool, allowing users to buy and sell at any time.

When the first user order comes in, let’s say for “YES,” both YES and NO options are minted. The YES option will be acquired by the user who placed the order, while the NO option will be acquired by the Automated Market Maker (AMM). This ensures that liquidity is maintained in every market, even if there is an imbalance at the beginning between YES and NO.

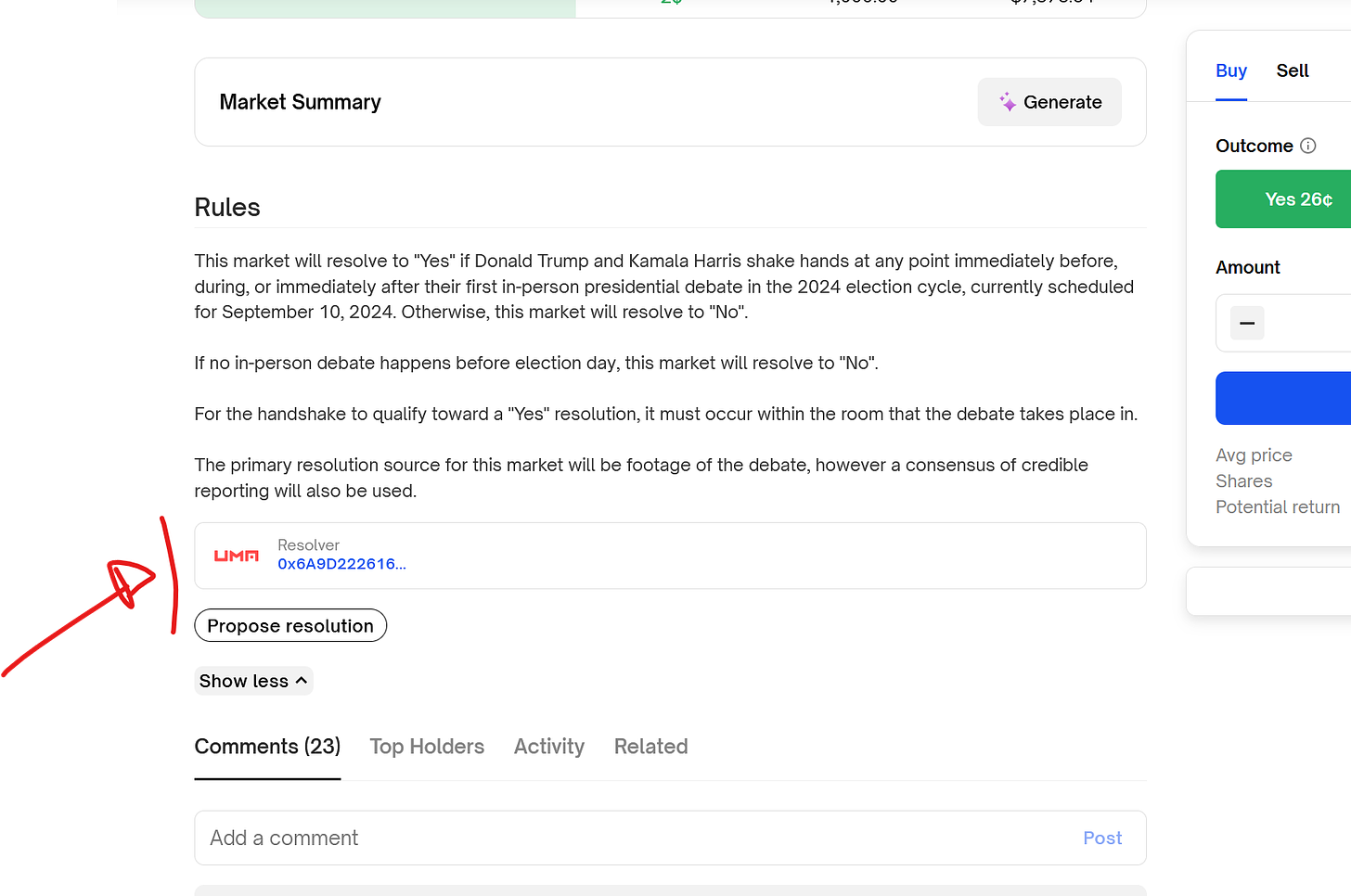

How does the UMA resolution system works?

Polymarket uses a UMA resolution system for every market. UMA is an independent oracle from Polymarket that provides unbiased verification of how an event traded on Polymarket should be resolved.

At any time, someone can propose the resolution of the market if they believe the resolution rules have been met. To propose a resolution, the person needs to pay a bond of around 750 USDC, which helps ensure that only serious resolution requests are submitted.

After the proposal of an event, a dispute period opens, during which other users can raise a dispute against the proposed resolution by posting another bond of 750 USDC.

If the proposed solution goes undisputed, the market is resolved according to the proposed outcome, and the person who proposed the outcome will receive back their 750 USDC bond, plus an additional 5 USDC as a reward for proposing the correct outcome.

How is it decided how a market will be resolved?

The market is resolved according to the rules set out below the market page. I suggest you read the rules carefully, as they can sometimes lead to different investment decisions based on the details.

At time when rule are unclear polymarket can issue additional clarification

Can I propose a market resolution?

Yes, anyone can propose a market resolution as long as they are willing to buy the UMA bond. You can trigger the market resolution by clicking the button below the market rules on the event page.

In a contested market, how can I make an argument for what I think is the correct outcome?

If a market is contested, it is possible to make an argument for the outcome you believe the market should resolve in favor of in the UMA Discord under the evidence rational thread.

How should I pick my first market?

As a first step, I suggest navigating the platform by topic. Identify the topic you know best, and place a bet on the one you believe you understand better than others. This will give you a better chance to assess whether the current odds make sense.

How can I recover my funds sent on the wrong network?

Polymarket does not provide guidance in this case. My suggestion would be to try reaching out to the asset recovery team of your crypto exchange.

How can I recover my funds if sent out the wrong cryptocurrency on Ethereum or Polygon?

In this case, Polymarket provides guidance. Please refer to the following link